IRS Discount Rate

The IRS Discount Rate – also called the 7520 Rate or Applicable Federal Rate (AFR) – is part of the calculation used to determine the charitable deduction for many types of planned gifts (example: CGAs). The IRS discount rate in simple terms is what the federal government estimates your rate of return would be should you invest your money at that point in time (in something stable like government bonds).

So, how does the IRS Discount Rate affect CGAs?

If the discount rate is higher, the IRS is assuming that you could make more money had this gift been invested. This results in a larger tax deduction upfront, but also a larger “earned income” portion of the lifetime distributions.

A lower discount rate, meaning less money to be made in investments, decreases the charitable gift amount for the donor. The upside is that the “earned income” portion of the distribution is also smaller, reducing the income tax liability over the life of the CGA.

The inverse is then true. If the discount rate is higher, the charitable deduction is greater because the Federal government assumes you would have made more money on the gift you gave away. But, because of this, the “earned income” portion of a distribution is larger, which could have implications depending on someone’s adjusted gross income (what the federal government bases our taxes on).

In conclusion, a donor who wants to maximize their deduction should select the highest rate available. This reduces the overall value of the annuity and increases the amount of the charitable gift. Conversely, a donor who wants to maximize the income tax-free portion of the annuity payments should select the lowest available rate.

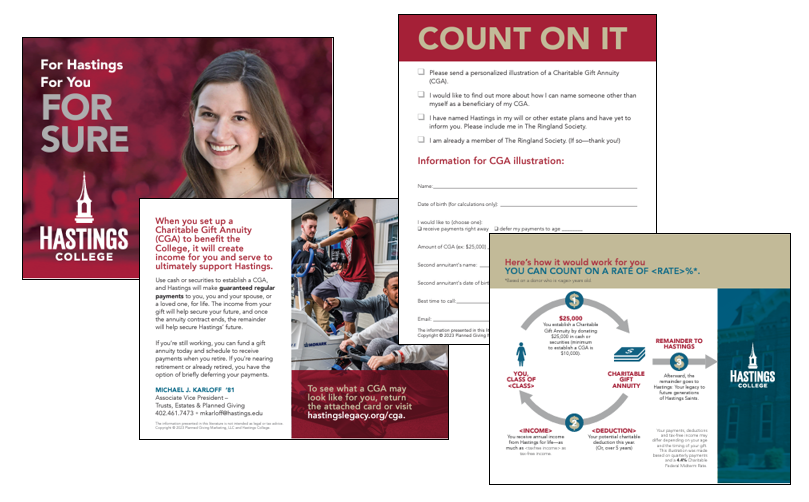

Marketing is meant to inspire donors and invite them to make an impact.

70 ½ vs. 73?

70 ½ vs. 73? We’ve been hearing some confusion from a lot of clients around the age split of 70 ½ vs. 73 for gifting from an IRA. Which is the correct age? What are the rules around each age? When it comes to marketing this great gifting strategy, the problem is both...

Wisdom Wednesday – Are you 85?

Are you 85? I didn't think so ...We've talked about the mindset of our most senior donors in the past. And we'll most likely talk about it forever. Why? None of us know what it's like to be 85 - unless we're 85.We've all been 16 before. Most of us have even recovered...

Generational Marketing – Traditionalists

Generational Marketing - TraditionalistsTraditionalists include those aged 77+ and will be a key group when it comes to your planned giving outreach.Learning how to communicate with this portion of the population is important for your success. Discovering the nuances...

Wisdom Wednesday – Planning for 2023

Planning for 2023 New year, new view on planned giving fundraising Look at it from your donor’s point of view, understand what they need and want, not what your organization needs or wants. The new year is a great time to pause, reflect, and reset. Most of us think...