Understanding the IRS Discount Rate for Charitable Gift Annuities

Tech Tuesday

With the signing of the Consolidated Appropriations Act of 2023 and the provision referred to as Secure 2.0, there is newfound interest around Charitable Gift Annuities* (CGAs). Because of this we’re all becoming reacquainted with the IRS Discount Rate – but what is it and how does it impact charitable giving?

What is the IRS Discount Rate?

The IRS Discount Rate – also called the 7520 Rate or Applicable Federal Rate (AFR) – is part of the calculation used to determine the charitable deduction for many types of planned gifts (example: CGAs). The IRS discount rate in simple terms is what the federal government estimates your rate of return would be should you invest your money at that point in time (in something stable like government bonds).

How Does the IRS Discount Rate Affect CGAs?

A donor who wants to maximize their deduction should select the highest rate available.

If the higher discount rate is chosen, the IRS is assuming that you could make more money had this gift been invested. This results in a larger tax deduction upfront, but also a larger “earned income” portion of the lifetime distributions.

If the lower discount rate is chosen, it decreases the charitable gift amount for the donor. The upside is that the “earned income” portion of the distribution is also smaller, reducing the income tax liability over the life of the CGA.

The Bottom Line: Which Rate to Choose?

In conclusion, a donor who wants to maximize their deduction should select the highest rate available. This reduces the overall value of the annuity and increases the amount of the charitable gift. Conversely, a donor who wants to maximize the income tax-free portion of the annuity payments should select the lowest available rate.

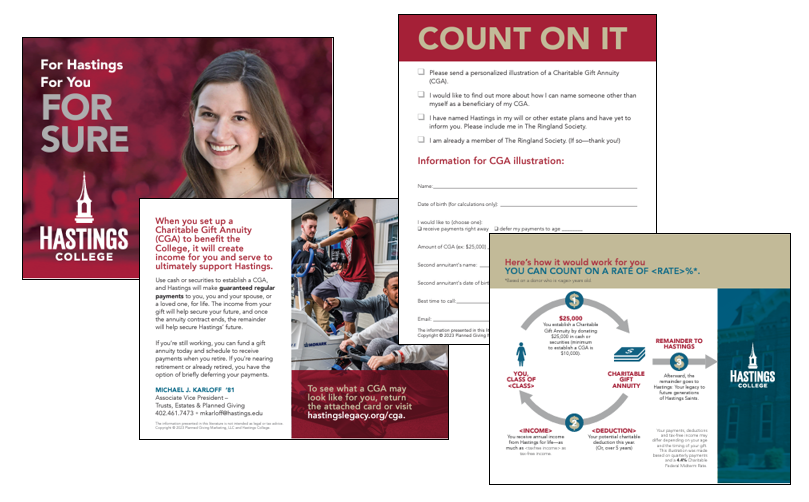

Inform your donors that you offer this type of gift with a customized CGA Campaign!